The movement to adopt value-based payment (VBP) in the U.S. health care system tends to focus on getting providers to assume financial risk. Recently, for example, the Centers for Medicare & Medicaid Services (CMS) finalized its plans to facilitate the transition to financial risk for providers participating in the Medicare Shared Savings Program. Under risk-based VBP models, providers are held financially responsible for some, if not all, health care costs if they exceed a predefined budget or a prospectively paid pot of money. In most VBP-related work — including efforts across commercial, Medicare, and Medicaid payers — there is an underlying goal of moving providers toward risk-based payment models in order to help accomplish the Triple Aim of better care, lower costs, and healthier people.

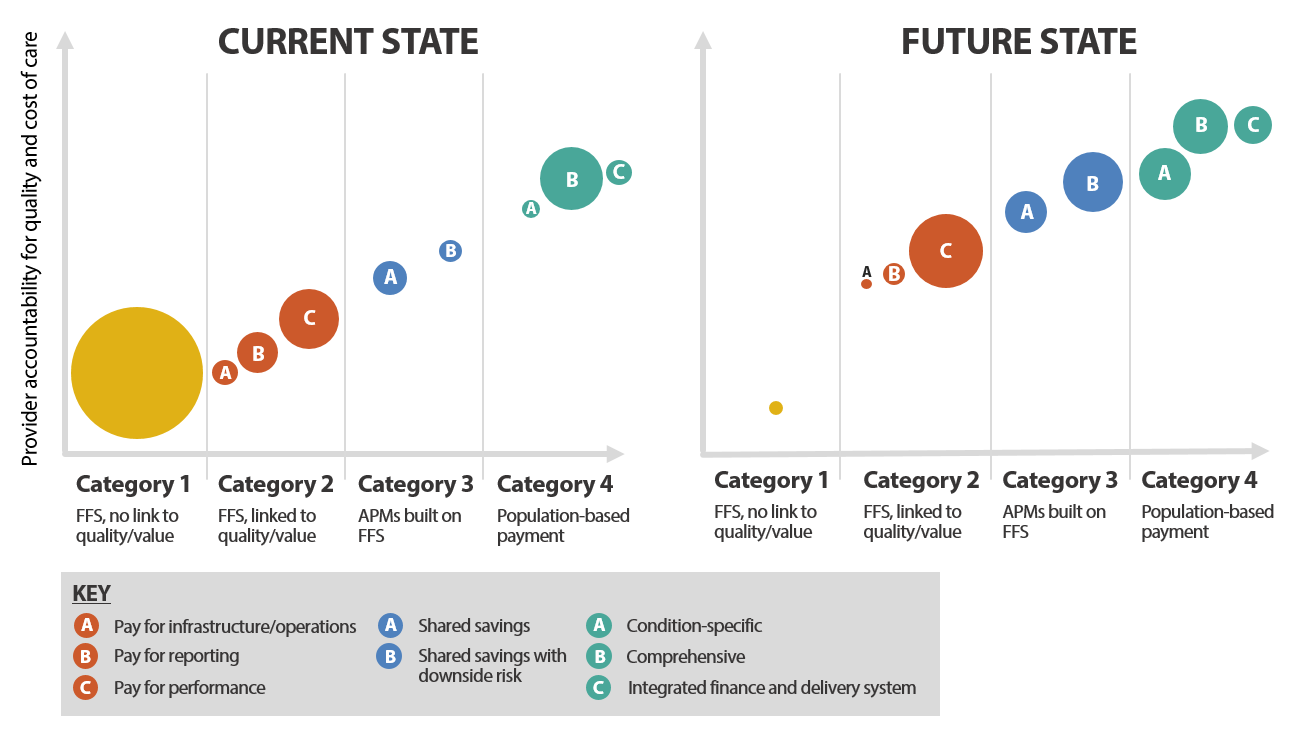

National goals for payment reform outlined under the Department of Health and Human Services’ Health Care Payment Learning & Action Network (LAN) shift the U.S. toward risk-based payment models including savings/shared risk, bundled payments, and population-based payments (see Categories 3 and 4 in Exhibit 1). In Medicaid, there are a range of state efforts to “up the ante” on VBP models. For example, six states received approval to have their Medicaid payment arrangements qualify as Advanced Alternative Payment Models under CMS’ Quality Payment Program in 2019, which requires a certain level of downside risk. Other states are leveraging initiatives such as Medicaid’s Innovation Accelerator Program for Value-Based Payment & Financial Simulations and Advancing Primary Care Innovation in Medicaid Managed Care to design, implement, and/or refine existing VBP models.

Exhibit 1: LAN Payment Reform Goals

Source: Health Care Payment Learning and Action Network. “ALTERNATIVE PAYMENT MODEL (APM) FRAMEWORK WHITE PAPER: REFRESHED 2017.” July 2017.

How Does VBP Financial Risk Impact Providers?

Health policy experts talk about the potential to encourage, gently nudge, and in some cases even force providers “farther to the right” on the LAN alternative payment model framework. But, providers are not embracing the shift en masse, and payers have found it challenging to get providers to voluntarily assume financial risk. Why is take up slow? Providers are well aware that managing financial risk effectively is expensive and can require additional staff and resources, such as capital reserves and data systems to manage financial benchmarks. In Medicaid, where providers often operate under razor-thin margins, the prospect of financial risk can be even more daunting. While risk may provide a powerful motivator for providers to stick to a budget and more effectively manage the costs of care, more research is needed to fully understand how risk impacts individual providers and the amount of risk-bearing needed to produce behavior change. For example, a study of two early adopter Medicaid accountable care organizations (ACO) states — Colorado and Oregon — found that Colorado exhibited a similar reduction in spending without the significant financial risk defining Oregon’s model. Other research has shown that financial incentives are generally not passed through from the organizational level to the provider level, meaning that individual physicians are often shielded from any downside risk associated with VBP contracts. Given providers’ hesitancy and questions surrounding the impact of financial risk on physician behavior and, ultimately, on the quality and cost of care, what exactly are the benefits of risk-based alternative payment models for providers?

Focusing Less on Risk, More on Flexibility

Some health policy experts have made a compelling case that the shift to VBP is not really about risk, but about flexibility — namely, the financial flexibility to provide the right care, in the right place, at the right time. The fee-for-service payment system is problematic not just because of its inherent incentives to increase the volume of services provided without regard for quality or cost. It also limits the care that providers generally deliver to those services that have an associated payment code. The fee-for-service payment system reimburses for services covered under a payer’s fee schedule, but does not typically reimburse for things that could help avoid an office or emergency department visit, such as responding to patient phone calls, coordinating with other providers, covering the salary of a care manager to help patients with chronic conditions, or addressing patients’ social determinants of health. Further, fee schedules typically limit where services can be provided (often limiting the place of service to a provider’s office) as well as who can provide services (often to the exclusion of high-value, culturally adept providers, such as community health workers and peer providers).

Newer fee-for-service codes such as those for certain types of behavioral health integration and telehealth services in Medicare do offer reimbursement for expanded types of services relative to traditional office-based codes; however, adding new billing options code-by-code and payer-by-payer is a cumbersome way to keep pace with innovation, as evidenced by the limited uptake of these new codes to date. Alternative payment models, such as population-based payments, provide broader flexibility in where, how, and by whom care is delivered, and inherently involve some risk. While this risk is a necessary by-product of changing from a fee-for-service based payment system to one that allows for more flexibility, it may be better viewed as a means to an end: the “ability to improve outcomes and reduce costs in a way that is financially feasible.”

Examples of VBP Supporting Flexibility and Care Transformation

A perfect example of this need for flexible dollars to support care transformation is illustrated by Southcentral Foundation, a health care provider for Native Alaskans in Anchorage, Alaska. Southcentral has integrated treatment for mental health into its primary care practices, and found that patient satisfaction rates skyrocketed, while the use of medical care went down. As a result, Southcentral has been a victim of its own success — because patients in its integrated practices needed less medical care, the doctors made less money. This conundrum is not unique to Southcentral. A study of integrated team-based care approaches found that integrated practices generate $115 per patient less annually, on average, than traditional fee-for-service payment methods. This means that, from a business perspective, provider practices confront financial disincentives for integrating care unless the payment model is changed to incentivize keeping patients healthy — something that population-based payments are well-equipped to do.

A number of states, including Connecticut and Rhode Island have promoted the virtues of flexibility in new VBP models, particularly in primary care. Rhode Island’s Office of the Health Insurance Commissioner (OHIC) Primary Care Alternative Payment model is a capitated approach designed to achieve better care, smarter spending, and healthier people by supporting primary care providers’ use of “flexible approaches to communication, monitoring, and treatment.” Notably, OHIC states that providers of any size can succeed under a capitated arrangement, and clarifies that the goal of the model is not to reduce primary care spending or to shift insurance risk to primary care providers. Designing population-based payment models that can apply to smaller providers is crucial given that practices with only one or two physicians have demonstrated the ability to provide high-quality, cost-effective care. Chris Koller, President of Milbank Memorial Fund, recently highlighted evidence demonstrating that “practices with just one or two physicians produced outcomes that were as good as those of their larger siblings and significantly better than practices with over 100 physicians.” Likewise, Connecticut is developing a new primary care bundled payment model that aims to provide practices with “true flexibility” by providing upfront payments to cover the time the care team spends doing traditionally unfunded or under-funded work such as home visits, telemedicine visits, and phone, e-mail or text support.

Looking Ahead

Moving forward, the drive toward VBP and risk-based payment models is likely to continue, with Medicaid leading the way in some cases. For example, community health centers and other safety net providers consider Medicaid and new opportunities around VBP to be the most promising future source of revenue for expanding their efforts related to social determinants of health. CMS is also emphasizing greater flexibility for providers and states, a willingness to test state-based and local models, and an interest in provider-led innovation. As the VBP journey continues, it may be worth focusing more directly on the move toward increased financial flexibility for providers that certain risk-based VBP models allow (and, consequently, on true payment reform that moves away from payment models built upon fee-for-service architecture), instead of on their increased financial risk.

As a family physician who has worked with “high risk” populations for many years, I could not agree more with the need for provider flexibility. AND…I believe this must start with how we choose, train, and reward clinical trainees (physicians, nurses, behaviorists, pharmacists, etc.). This should come both from leaders of these training centers and from health economists and thought leaders in healthcare financing.